The Intricacies of Estate Planning

Estate planning is not just for the rich or retired. It provides instructions should you become incapacitated or how to care for minor children. More importantly, it becomes a living document as assets fluctuate and conditions change. Without it, acquired assets can wind up in probate for years while ex-wives, children and business partners all via for inheritance of the assets. With a little planning, you can avoid having your assets tied in probate while the court determines the distribution of your assets.

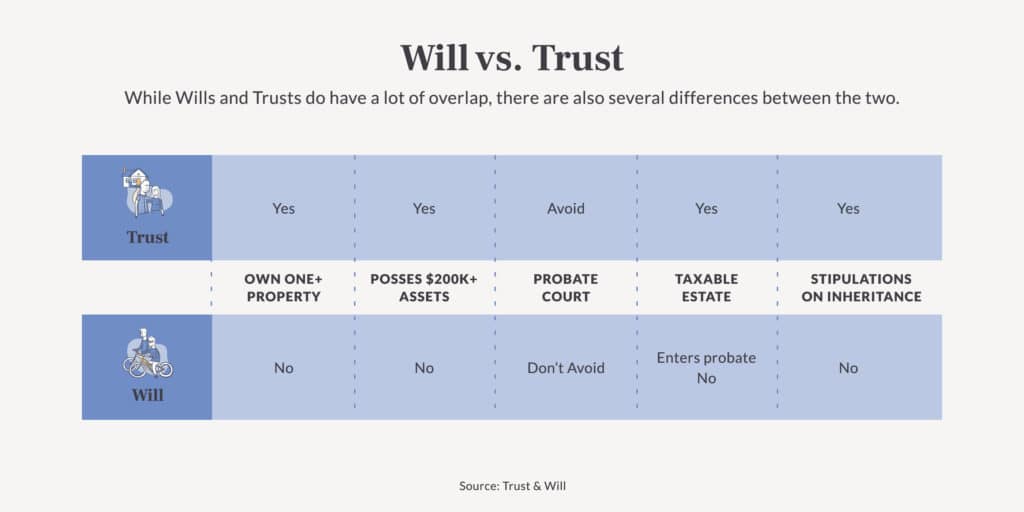

The first step is to have a will or trust. They have their differences and share some similarities and which is appropriate for you will take some analysis. One basic distinction between the two is that a will does not take effect until the owner dies, while a trust becomes effective once it is signed. This usually avoids the property being tied up in probate as things get sorted out. Once the will or trust is completed, then an executor or power of attorney makes sure that the assets are distributed as instructed. For instance, the beneficiary may not be entitled to assets until she/he reaches the age of 21; Or the owner may become incapacitated and has the power of attorney to carry out final decisions.

Proper estate planning is an intricate process that requires delibrate planning to maximize tax benefits and avoid any confusion. We here at Elder Care Law Firm would love to take the time to go over your unique situation and start an Estate plan for you. You can learn more about us at https://www.elderlycarelawfirm.com/estate-disability-planning/.